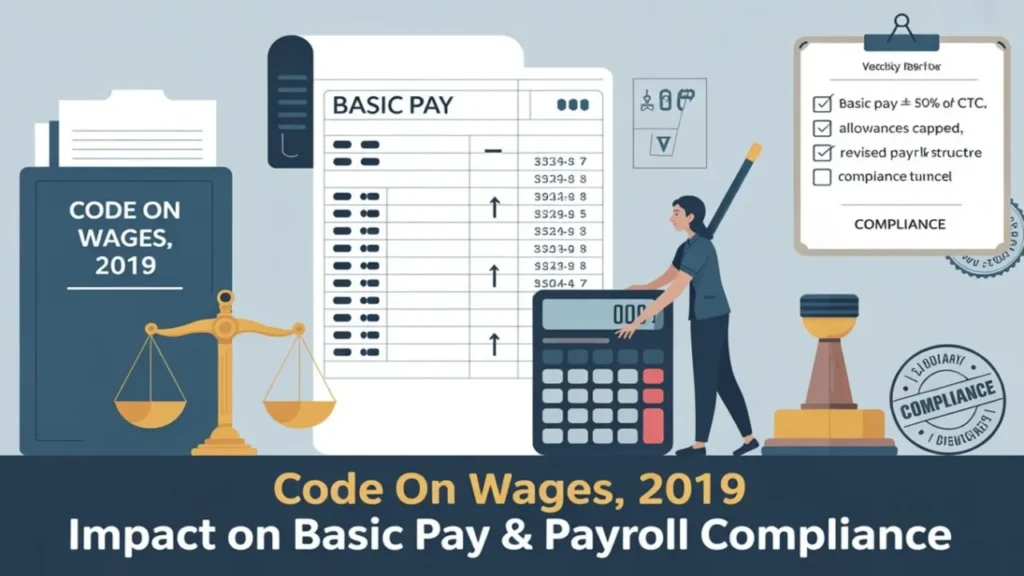

The Wage Code 2019: India’s Pay Structure Could Transform the Working Economy

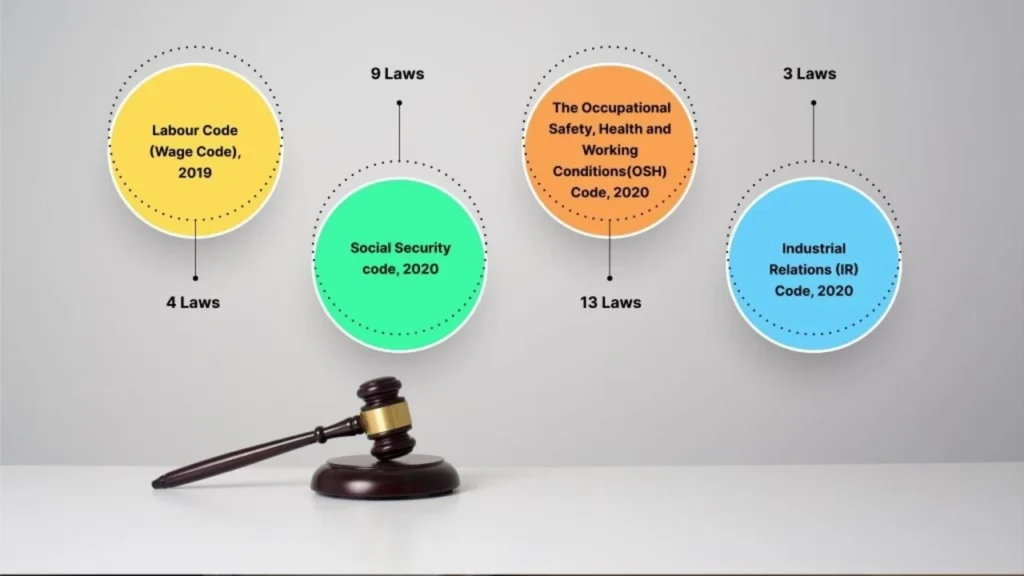

The Wage Code 2019: India’s Pay Structure Could Transform the Working Economy The Code on Wages, 2019 is one of the most significant Labour reforms introduced by the Indian government in recent decades. It marks a major shift in how wages, bonuses, and pay-related compliance are regulated across industries. Designed to simplify and consolidate multiple […]