What Is the New Labour Code? – A Complete, Detailed Explanation

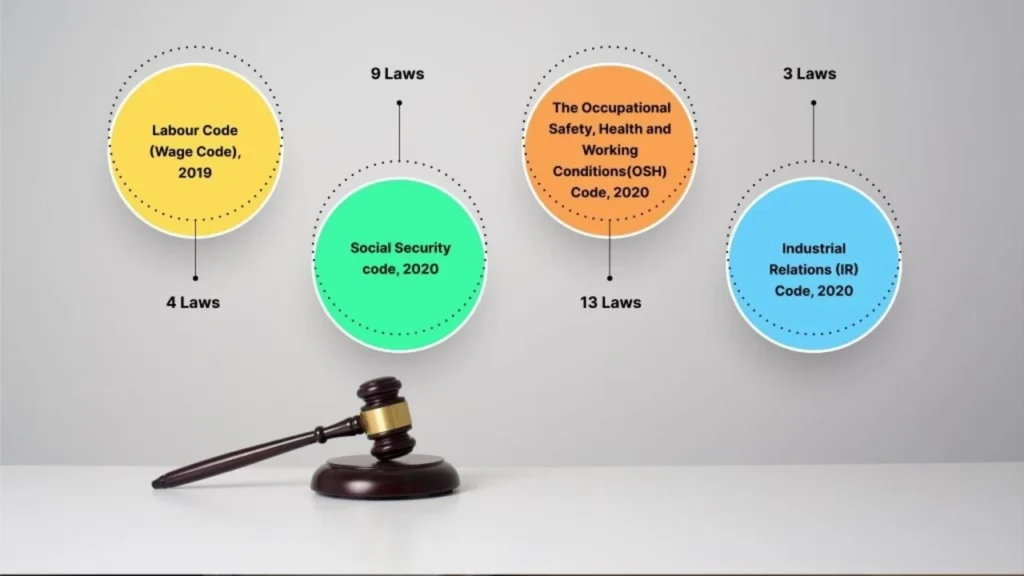

India’s labour laws have historically been complex, fragmented, and difficult for both employees and employers to navigate. For decades, the country had more than 40 separate labour laws, many of which overlapped or had conflicting provisions. To simplify this system and create a modern framework for labour regulations, the Government of India undertook one of […]